NYC Flagship Launch

Led meticulous creative direction and built unified digital-to-physical branding for the $10M Madison Avenue flagship, aligning with marketing initiatives and boosting foot traffic by 40%.

Skip to…

Madison Ave:

Where Luxury Brands Build More Than a Presence

Madison Avenue isn’t just a street—it’s a global symbol of luxury heritage, exclusivity, and innovation. Strategic digital design extends this prestige beyond the storefront, using unified assets across online and offline channels to drive high-value traffic, elevate brand storytelling, and reinforce the cultural capital that makes Madison Avenue iconic.

who we’re targeting

Watch Influencers/Enthusiasts/Collectors

Major hubs like New York City likely host dozens—potentially 30–50—specialist watch influencers including mega, macro, and micro creators.

2. Loyal Customers

Panerai’s most dedicated buyers comprise a global circle of over 30,000 Paneristi, who convene for events like P‑Day and gain first access to exclusive limited-edition releases—reinforcing deep brand loyalty and identity

3. Experience-Driven Consumers

Experience-driven customers are essential because they are loyal, high-spending, influential, and community-focused. For Panerai, targeting this group means ensuring that every digital and physical asset—whether it’s a flagship launch, a virtual concierge service, or an Instagram campaign—delivers an unforgettable brand experience.

S

-

Panerai’s boutique merchandising and online presence reflect the same heritage-driven narrative, using cohesive visuals, curated product assortments, and premium materials to reinforce its luxury identity.

-

Physical stores are highly selective, offering immersive displays, product heritage storytelling, and curated collections that enhance exclusivity.

-

Each watch now carries a blockchain-backed digital passport (via Arianee), ensuring authenticity, traceability, and ownership history across online and offline sales channels.

-

Online product pages showcase detailed photography, videos, and 360° views—helping replicate the tactile luxury experience digitally.

W

-

While online product pages are visually strong, Panerai lags behind competitors in AR try-ons, virtual boutique experiences, and dynamic personalization.

-

Heavy reliance on in-store relationships limits direct digital acquisition; fewer interactive catalogues or omnichannel campaigns targeting younger, tech-savvy luxury buyers.

-

Offline boutiques are geographically concentrated; combined with limited online localization, this restricts accessibility in emerging markets.

O

-

Develop immersive virtual store environments, mobile-optimized catalogues, and online-exclusive drops that integrate seamlessly with boutique experiences.

-

Use digital passports and browsing data to personalize merchandising—curated collections, loyalty-based offers, or concierge-led online consultations.

-

Incorporate richer heritage content, AR try-ons, live-stream launches, and interactive watch configurators to bring physical merchandising energy into digital channels.

T

-

Brands like Rolex, Omega, and Cartier have invested heavily in advanced omnichannel merchandising and interactive e-commerce, raising customer expectations.

-

Unauthorized online sales undermine both physical and digital merchandising efforts, even with digital passport safeguards.

-

Younger luxury consumers expect immersive, frictionless omnichannel experiences; failure to evolve could impact relevance.

-

Economic uncertainty or travel restrictions impact boutique traffic and high-value watch purchases, pushing more pressure on digital merchandising capabilities.

Competitive Analysis

Rolex

-

Extremely robust product pages with deep storytelling, configurators for watch customization, and immersive AR try-on features (via authorized retailers).

Strong global retailer network with standardized merchandising guidelines; in-store displays emphasize product exclusivity and brand prestige.

-

No direct e-commerce; relies on retailer networks for transactions, limiting full control over online merchandising.

Less flexibility across independent retailers (merchandising consistency can vary).

Omega

-

Comprehensive e-commerce platform with direct purchasing; strong storytelling tied to heritage events (e.g., Olympics, space exploration); watch configurators and interactive imagery.

Larger boutique footprint and partnerships with high-end retailers; well-curated, event-driven merchandising (special exhibitions, themed launches).

-

Slightly less premium brand aura than Rolex; limited online exclusives.

Occasionally less brand-controlled than Panerai’s boutique-only model.

Cartier

-

Highly personalized digital concierge services, virtual appointments, and exclusive online drops; immersive AR try-on and product customization tools.

Flagship boutiques are immersive luxury spaces with strong cross-category merchandising (jewelry, watches, accessories); extensive global footprint.

-

High demand can cause stock shortages online; complexity of managing multiple product categories.

Less niche focus on watches compared to Panerai or Rolex.

Audemars Piguet

-

Exclusive AP Houses and a small boutique network create a strong luxury aura but limit access for customers in less-developed markets.

While scarcity boosts desirability, it can also frustrate potential buyers and push them toward competitors or grey markets.

-

AP offers minimal online purchasing options, relying heavily on physical boutiques and waitlists, which can alienate digital-first consumers.

While visually strong, online catalogues lack features like AR try-ons, watch configurators, and personalized recommendations seen in competitors like TAG Heuer or Cartier.

Key Takeaways

1

-

Luxury brands that merge offline boutique experiences with online convenience are leading the market. Cartier and TAG Heuer excel at connecting online catalogs, virtual appointments, and in-boutique product availability. Panerai and Audemars Piguet still lean heavily on boutiques, missing opportunities to bridge digital and physical channels.

2

-

Competitors like TAG Heuer and Omega offer AR try-ons, watch configurators, and immersive product pages, bringing the boutique experience online. Panerai and Audemars Piguet rely on static visuals, limiting engagement and conversion potential on digital platforms.

3

-

Luxury consumers expect tailored product merchandising online and offline. Cartier leads in data-driven personalization through digital concierge services and curated in-store experiences, while Panerai and Audemars Piguet underutilize tools like digital product passports to create bespoke journeys.

4

-

Competitors are enhancing offline merchandising with digital touchpoints like interactive displays, virtual configurators, and digital product passports visible in boutiques. Panerai and AP boutiques still focus heavily on traditional displays and could modernize with these tools.

Ideation

During the ideation phase, our team collaborated to explore ways to elevate Panerai’s product merchandising by seamlessly connecting the brand’s boutique heritage with its digital catalogue experience. Together, we brainstormed opportunities to enhance online interactivity, integrate personalized recommendations, and bridge digital touchpoints with in-store experiences. By co-creating user flows and analyzing both online and offline merchandising challenges, we generated a series of high-impact concepts that reinforced brand storytelling, improved product discoverability, and deepened customer engagement. These collective ideas became the foundation of our design roadmap, guiding the prioritized features that would strengthen Panerai’s presence across all channels.

visual brainstorm

what we set on…

-

Implement a clean, minimal UI with intuitive navigation for faster product discovery.

Add a sticky navigation bar for quick access to categories (e.g., watches, straps, services).

Include visual breadcrumbs so clients know where they are in the catalogue.

-

Create personalized recommendations based on the client’s purchase history or browsing behavior.

Allow sales associates to curate collections for each client prior to boutique appointments.

Add customizable watch builders where clients can swap straps and dials virtually.

-

Sync the catalogue with inventory data for real-time availability.

Enable sales associates to place orders directly from the catalogue.

Introduce a client profile integration, so associates can log preferences and wishlists instantly.

-

Integrate 360° product spins and zoomable HD images for detailed viewing.

Use AR try-on functionality (e.g., try a watch virtually on the client’s wrist via iPad).

Add immersive brand storytelling videos within product pages.

behind the results

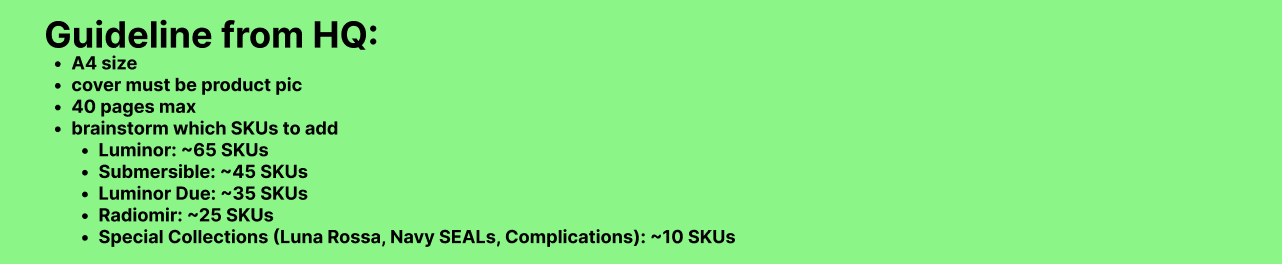

I led the coordination of cross-functional teams and external vendors for the production of Panerai’s Digital Catalogue. This snapshot highlights how I organized timelines, vendor-ready production specs, and HQ guidelines into one centralized view. From cover design options and table of contents layouts to detailed vendor specifications, I ensured alignment, brand consistency, and smooth execution across all stakeholders.

testing

We conducted a usability study with 10 participants, including customers and boutique sales associates, to evaluate how effectively the Panerai Digital Catalogue supports product discovery and comparison. While the catalogue’s design and brand storytelling were well-received, users experienced difficulty locating specific SKUs and differentiating similar models. Recommendations focused on improving navigation with an interactive index, clearer SKU filtering, and simplified technical specifications to deliver a more seamless luxury experience.

-

70% of participants struggled to locate a specific model (e.g., PAM02661) within 2 minutes, citing challenges with the static index and lack of filters.

-

Average time to find a product was 1:42 minutes, exceeding the target of under 1 minute per task by 42%.

-

System Usability Scale (SUS) score averaged 76/100, with participants praising the design quality but requesting clearer navigation paths and model comparisons.

Now introducing...

Now introducing...

results

We conducted a usability study with 10 participants, including customers and boutique sales associates, to evaluate how effectively the Panerai Digital Catalogue supports product discovery and comparison. While the catalogue’s design and brand storytelling were well-received, users experienced difficulty locating specific SKUs and differentiating similar models. Recommendations focused on improving navigation with an interactive index, clearer SKU filtering, and simplified technical specifications to deliver a more seamless luxury experience.

-

90% of participants rated the catalogue’s design as “luxury-aligned” and “visually compelling,” reinforcing Panerai’s premium brand identity.

-

80% of users reported that the product photography and storytelling enhanced their understanding of each collection, making the catalogue engaging and informative.

-

75% of participants successfully used QR codes to access product pages without assistance, praising the seamless transition between print and digital experiences.